Creating Scalable Feedback Loops with Product: The SE's Hidden Leverage Point

Why Smart Sales Engineers Build Feedback Systems That Shape Product Strategy

I learned about the power of structured feedback the hard way during my second year as an SE at an enterprise SIEM vendor. We had been losing deals consistently to a competitor who offered faster real-time correlation engines, and I was getting tired of the same conversation in every security operations center demo. The CISO would ask about correlation performance during high-volume security events, and I'd watch their confidence erode as I explained our processing delays and performance limitations during peak loads. After the fifth deal slipped away for the same reason, I realized I had been treating each correlation speed question as an isolated technical inquiry rather than recognizing it as part of a larger market shift toward real-time threat detection capabilities.

That experience taught me something fundamental about the SE role that most people miss. We bridge the gap between market reality and product capability, which means we see patterns before anyone else in the organization. The question is whether we recognize these patterns and act on them systematically, or whether we let valuable intelligence disappear into the chaos of quarterly quota pressure.

In enterprise software, there exists a constant tension between what gets promised during sales cycles and what gets delivered by the product over time. Every SE has lived this reality: sitting in a meeting where the buyer asks for a capability that is close, but not quite, in the product. We either demo around it, sketch a workaround, or acknowledge the gap honestly and discuss roadmap timing. The real question, though, is not how we handle that moment in the meeting but what happens to that feedback after the call ends.

Far too often, feedback gets lost in the shuffle. It gets mentioned in passing on a forecast call or logged hastily in a CRM field that no one reads. At best, it makes its way into a Slack thread that disappears by the end of the week. The result is that product teams never see the full weight of customer demand, while sales teams repeatedly face the same objections. This is where the SE plays a vital role, not just as a solution expert, but as the facilitator of feedback loops that connect the voice of the customer to the heartbeat of product development.

The Intelligence Gap That Sabotages Both Sales and Product Success

I've observed that many organizations operate under the illusion that they already have effective feedback systems in place. After all, most companies claim to be customer-driven and invest heavily in customer success teams, support tickets, and quarterly business reviews. The reality, however, reveals a more nuanced picture where valuable market intelligence gets lost in translation between customer conversations and product strategy, creating a gap that undermines both sales effectiveness and product direction.

The breakdown happens at multiple levels, and understanding these failure points is crucial for SEs who want to build something better. Sales Engineers operate under tremendous time pressure and tend to focus on immediate deal progression rather than systematic intelligence gathering. We're trained to be responsive in the moment, which means we excel at addressing immediate concerns but often miss the opportunity to document the deeper context that makes feedback actionable. I've watched talented SEs give brilliant technical explanations during demos, then fail to capture why the prospect was asking about a specific capability in the first place. They solve the immediate problem but lose the strategic insight about what market forces are driving that requirement.

This contextual blindness creates a cascade of missed opportunities throughout the organization. Product managers receive fragmented input that lacks the business context they need to make informed decisions. A feature request that seems like a nice addition from one customer might actually represent a fundamental shift in how an entire market segment operates. Without proper context about deal size, competitive dynamics, implementation timeline, and regulatory pressures, even well-intentioned product teams end up dismissing legitimate signals as anecdotal rather than representative. They build features that address symptoms rather than root causes, or they ignore requests that could unlock entire market segments.

Sales leaders compound this problem by prioritizing immediate revenue blockers over long-term market signals. This reactive orientation makes sense from a quarterly perspective, but it creates a pattern where teams repeatedly encounter the same objections without ever addressing their root causes.I've watched sales organizations hire additional SEs to manage the increased workload created by repeatedly addressing the same product gaps across multiple deals, when those objections could have been eliminated by addressing underlying issues identified months earlier. The cost of this reactive approach extends beyond headcount inefficiency to include longer sales cycles, reduced win rates, and erosion of competitive differentiation over time.

The most damaging aspect of this intelligence gap is how it affects customer relationships and market positioning. Buyers have become remarkably sophisticated about distinguishing between companies that genuinely listen to customer input and those that simply collect feedback as a check-box activity. Prospects see their requests disappearing into a corporate blackhole and begin to question whether the vendor will be responsive to their needs after the contract is signed. This erosion of trust often proves more damaging than the specific feature gaps themselves, because it signals to customers that the organization lacks the processes necessary for effective partnership.

Consider how this plays out in competitive situations. Companies with effective feedback systems can demonstrate to prospects how customer input has influenced recent product decisions, roadmap priorities, and strategic direction. They can point to specific features that were built because customers requested them, and they can show timelines for addressing current gaps based on validated market demand. This transparency creates a compelling narrative about responsiveness that extends far beyond feature comparisons. Companies without these systems find themselves defending individual feature gaps without being able to demonstrate market responsiveness.

The intelligence gap also creates internal friction that undermines effectiveness. Sales teams begin to view product teams as disconnected from market reality, while product teams see sales feedback as inconsistent and unreliable. This mutual frustration leads to defensive behaviors where each team focuses on protecting their metrics rather than collaborating on market success. Sales teams stop providing detailed feedback because they believe it gets ignored, while product teams stop engaging with sales input because it lacks the structure and context they need for effective decision-making.

The SEs who recognize this dynamic and build approaches to bridge the intelligence gap create sustainable competitive advantages for their organizations. They transform from reactive problem-solvers into proactive market intelligence strategists who shape product strategy through customer insights. This transformation requires developing skills that extend beyond technical expertise to include pattern recognition, strategic analysis, and clear communication across organizational boundaries.

Building Intelligence Capabilities That Compound Market Understanding

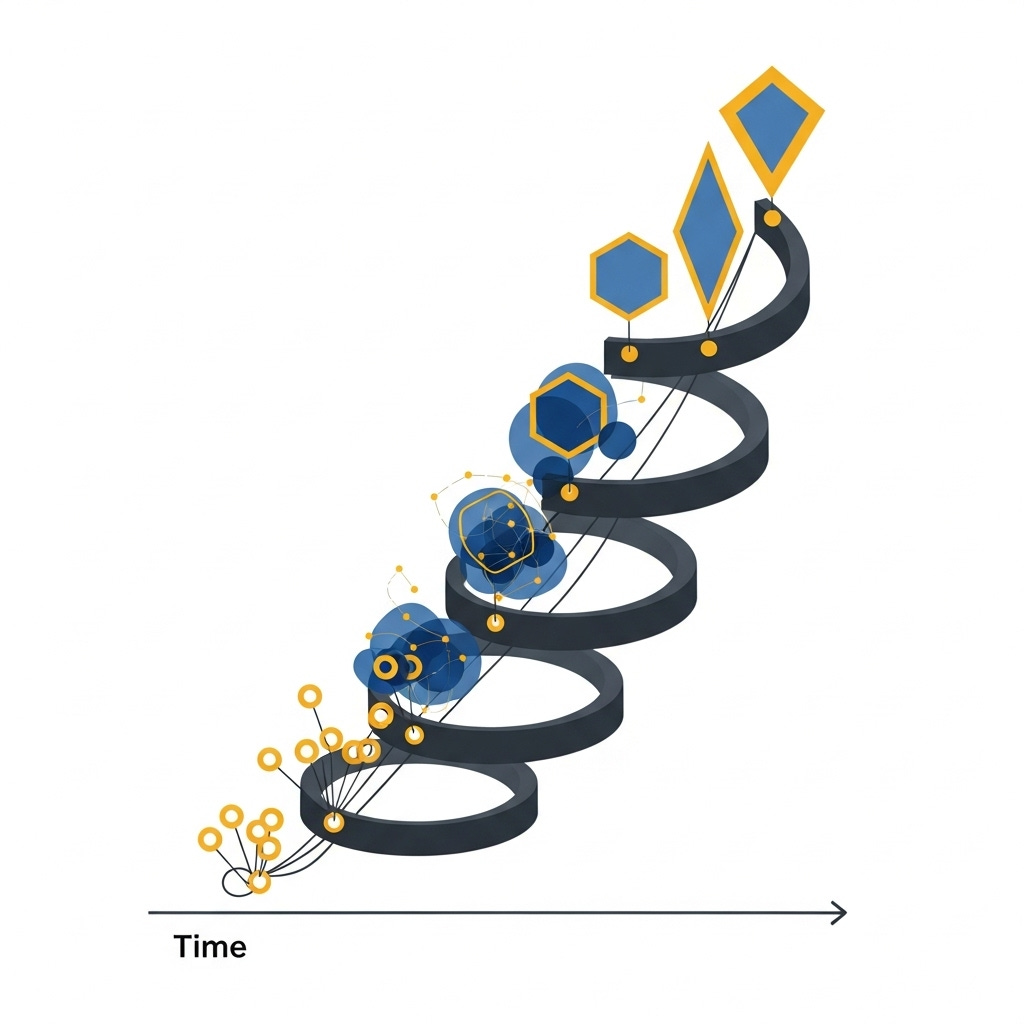

In my experience, the SEs who shape product direction most successfully approach feedback not as an administrative task, but as a market intelligence system that compounds value over time. They understand that each customer interaction represents more than just an opportunity to advance a deal; it constitutes a data point that, properly aggregated and analyzed, can influence roadmaps, shape positioning, and even redefine market strategy. This requires developing market intuition, which is the ability to sense when individual requests point toward larger shifts in customer expectations or competitive dynamics.

Building effective intelligence systems starts with recognizing that context determines value in feedback collection. A feature request without context about competitive pressure, regulatory requirements, implementation timeline, or business impact provides limited guidance for product prioritization. However, the same request accompanied by detailed context about why the customer needs that capability, what alternatives they're considering, and how it fits into their strategic objectives becomes a valuable piece of market intelligence that can influence product strategy.

Let me share a specific example of how modern feedback tools transformed product strategy. During my time with a global DDI provider (DNS, DHCP, and IP address management), our SE team was consistently encountering product gaps during technical discussions. Large organizations would request advanced API & automation capabilities for IP address lifecycle management that weren't fully developed in our platform. Initially, each SE was handling these gaps individually, either by demonstrating manual processes or acknowledging the limitation honestly while discussing potential automation roadmap timing.

Rather than rely on the manual tracking approaches of the past, we implemented Vivun to systematically capture and structure this feedback from our technical discussions. The platform automatically captured automation requests from customer interactions, immediately tagging each gap with customer segment, network size, competitive context, and revenue impact. Vivun's integration with our product management tools ensured that every automation request was logged with full business justification, while the platform's analytics quantified exactly which deals were affected by missing lifecycle management capabilities.

Within a single quarter, the structured analysis revealed that IP address lifecycle automation wasn't just a convenience feature but a critical requirement for enterprises managing complex, multi-site network infrastructures. The data showed that organizations with more than 10,000 managed IP addresses consistently required automated provisioning and deprovisioning workflows, representing significant pipeline impact. This quantified feedback gave our product team the business case they needed to prioritize automation development.

The intelligence accelerated product development of automated IP lifecycle management from a "nice-to-have enhancement" to a current-quarter engineering priority. When we shipped the automation capabilities, Vivun's tracking helped us immediately re-engage previously stalled enterprise prospects, directly contributing to improved win rates in the large enterprise segment.

Equally important, the structured approach gave sales teams a clear method for handling objections before they became deal blockers. Instead of reactive explanations, SEs could proactively address IP automation concerns by showing prospects the company's timeline for lifecycle management capabilities and demonstrating how customer feedback had directly influenced product strategy. This transparency created a sense of partnership that extended far beyond the immediate deal, because prospects could see evidence of an organization that genuinely responded to market needs.

The structural elements that made this system effective provide a template for other organizations. First, the categorization framework captured both quantitative patterns and qualitative context necessary for strategic decision-making. Second, the regular review rhythm ensured that patterns were identified quickly enough to influence product planning cycles. Third, the communication framework translated sales intelligence into product language that enabled effective collaboration between teams. Finally, the feedback loop back to customers demonstrated organizational responsiveness that enhanced competitive positioning.

Successful intelligence systems also require what I call analytical discipline from participating SEs. This means developing the ability to distinguish between individual customer preferences and market-wide trends, understanding how competitive dynamics influence customer requirements, and recognizing when seemingly technical requests actually reflect broader business or regulatory pressures. SEs need to become skilled at asking follow-up questions that reveal the underlying business context that makes feedback actionable for product teams.

The most sophisticated systems also track feedback resolution over time, creating accountability loops that ensure market intelligence actually influences product decisions rather than just generating reports that get filed away. This requires establishing clear communication channels between sales and product teams, along with regular review processes that evaluate how well the organization responds to validated market signals.

The Strategic SE's Path to Organizational Influence

The SEs who master market intelligence develop influence that extends far beyond individual deal success toward shaping organizational strategy and market positioning. This transformation from tactical supporter to strategic contributor requires understanding how market intelligence compounds value over time and recognizing the career implications of developing these capabilities.

When feedback systems operate effectively over extended periods, they create advantages that extend far beyond individual product decisions or sales cycles. Organizations begin to develop a form of market intuition, which is the ability to anticipate customer needs before competitors recognize emerging trends. This manifests throughout the organization as product teams build capabilities that address tomorrow's customer requirements rather than just today's feature gaps, marketing teams develop positioning that resonates with evolving customer priorities, and sales teams articulate value propositions that address concerns before prospects even raise them.

The compound effect also transforms how customers perceive the organization's strategic direction. Instead of viewing product updates as reactive responses to competitive pressure, customers begin to see evidence of thoughtful market leadership. This perception shift often proves more valuable than the specific features themselves, because it influences how customers evaluate long-term partnerships rather than just immediate functionality. Customers start viewing the organization as a strategic partner that understands market direction rather than just a vendor that responds to immediate requirements.

For SEs who want to establish themselves as influential contributors rather than tactical supporters, developing market intelligence skills offers a clear path toward company-wide influence. The challenge lies in developing feedback practices that balance structure with agility, which means enough consistency to identify meaningful patterns, but sufficient flexibility to adapt quickly as market conditions change or new opportunities emerge. This requires developing fluency in product management language and presenting feedback in formats that product teams can easily incorporate into their existing workflows.

The career implications of mastering these abilities extend beyond immediate sales success toward leadership opportunities within product-focused organizations. SEs who can demonstrate market intelligence skills often transition successfully into product management, market strategy, or sales engineering leadership roles because they've developed the analytical frameworks and market intuition that these positions require. They understand how to translate customer conversations into strategic insights, how to validate market trends through deep analysis, and how to communicate market intelligence effectively across organizational boundaries.

Setting appropriate expectations becomes critical for maintaining both team morale and organizational credibility throughout this development process. Not every customer request will make the roadmap, and not every pattern will warrant a strategic pivot. However, by establishing consistent rhythms of feedback capture, analysis, and communication, SE organizations can ensure they influence strategy rather than merely react to whatever emerges during sales conversations. This requires developing strategic patience, which is the ability to build capabilities over time rather than expecting immediate organizational transformation.

The measurement approach for these activities needs to capture both qualitative and quantitative impact while remaining simple enough to maintain consistently. Product impact metrics should track how feedback influences roadmap decisions, feature prioritization, and development timeline acceleration. Sales impact becomes visible through reduced objection frequency, shortened sales cycles, and improved competitive win rates in areas where feedback has driven product improvements. These metrics take time to develop, but they provide compelling evidence that market intelligence activities contribute directly to revenue outcomes rather than just creating additional administrative overhead.

The sustainability of these systems depends on product team engagement and SE team buy-in over extended periods. Product managers need to see that feedback provides better market intelligence than they can gather through traditional customer research methods. SEs need to see that their investment in structured feedback collection leads to product improvements that make their jobs easier and more successful over time. Organizations that maintain effective feedback systems over multiple years often discover that the process becomes self-reinforcing, with product teams requesting specific market intelligence from SEs and customers expecting the level of responsiveness that feedback enables.

Through my years of observing SE organizations across different companies and market segments, I've noticed that the most influential individual contributors invariably develop structured approaches to market intelligence. They don't just respond to customer questions more effectively; they anticipate market shifts and help their organizations prepare for changes before competitors recognize emerging trends. This capability becomes particularly valuable during periods of market transition, where market intelligence provides early warning signals about shifting customer priorities or emerging competitive threats.

The advantage also extends to personal brand development within technical sales communities. SEs who consistently identify market trends and influence product strategy develop reputations as strategic thinkers rather than just technical experts. This reputation opens doors to speaking opportunities, advisory positions, and career advancement that purely tactical excellence rarely provides. They become recognized as market experts who understand not just how products work, but how markets evolve and how customer needs change over time.

For those willing to think clearly about market intelligence, the opportunity extends far beyond individual quota achievement toward shaping the direction of the entire organization. The feedback loops we build today determine the product capabilities our companies will have tomorrow, and the SEs who recognize this responsibility position themselves as architects of sustainable competitive advantage rather than just responders to immediate customer needs. This represents the essence of strategic influence: building systems that compound value over time while creating market advantages that competitors cannot easily replicate.